SEC Forms Crypto Task Force to Tackle Regulatory Challenges in Digital Assets

The U.S. Securities and Exchange Commission (SEC) has announced the creation of a specialized “crypto task force” to tackle the complex regulatory challenges in the rapidly evolving digital asset industry. This task force, spearheaded by acting Chairman Mark T. Uyeda and led by Commissioner Hester Peirce, underscores the agency’s commitment to navigating the intricate balance between fostering innovation and ensuring investor protection.

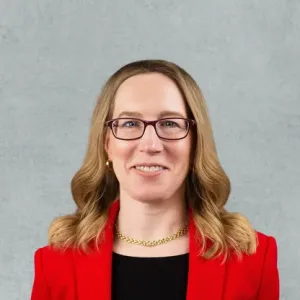

Commissioner Hester Peirce, often referred to as “Crypto Mom” for her supportive stance on blockchain and cryptocurrency advancements, brings a wealth of knowledge and advocacy to the task force. Her leadership is expected to shape a more transparent and forward-thinking regulatory environment, addressing criticisms of the SEC’s historically cautious approach to digital assets.

In a press release, Chairman Uyeda emphasized the importance of this initiative: “The digital asset space is transforming the financial landscape at an unprecedented pace. It is crucial that we establish clear, consistent, and fair guidelines to protect investors while enabling innovation.”

The SEC’s acknowledgment of existing regulatory ambiguities marks a significant shift toward a proactive engagement with the crypto industry. The task force aims to:

- Clarify Regulatory Frameworks: Address gaps in existing securities laws as they apply to cryptocurrencies and decentralized finance (DeFi) platforms.

- Promote Market Integrity: Develop measures to curb fraudulent activities, market manipulation, and cybersecurity risks within digital asset markets.

- Encourage Innovation: Work collaboratively with industry stakeholders to create an ecosystem where technological innovation can thrive under regulatory certainty.

- Enhance Investor Education: Provide resources to help investors better understand the opportunities and risks associated with cryptocurrencies.

This initiative comes amid increasing global regulatory scrutiny of cryptocurrencies. As the U.S. competes with other jurisdictions to lead in digital finance innovation, the SEC’s proactive stance could play a pivotal role in shaping the future of crypto regulation.

Industry experts and stakeholders have welcomed the formation of the task force, viewing it as a potential catalyst for greater clarity and stability in the U.S. crypto market. However, some remain cautiously optimistic, citing the need for balanced regulations that do not stifle growth or innovation.

As the task force begins its work, the crypto community will be closely watching for tangible outcomes that could define the next chapter of digital asset regulation in the United States.