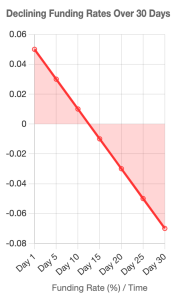

The cryptocurrency market is experiencing a subtle yet significant shift. Declining funding rates, a key indicator in futures markets, are signaling a growing bearish sentiment among traders. This trend, observed across major exchanges, suggests that speculators are increasingly betting against price gains, potentially ushering in heightened selling pressure.

Declining funding rates signal a shift towards bearish sentiment in the market, potentially leading to increased selling pressure. This trend may prompt traders to adopt more cautious strategies, impacting overall market dynamics.

Funding rates, which balance perpetual futures contracts by charging fees to either long or short positions, have been trending negative in recent weeks. This indicates that short sellers are paying longs to maintain their positions, a sign that bearish momentum is gaining traction. As funding rates dip, the cost of holding long positions rises, discouraging bullish bets and amplifying downward pressure on prices.

This shift is prompting traders to rethink their strategies. Many are moving away from aggressive long positions, opting instead for hedging techniques or reducing leverage to mitigate risk. Some are turning to options markets, purchasing puts to capitalize on potential declines, while others are scaling back exposure entirely, awaiting clearer signals.

The broader implications for market dynamics are notable. Increased selling pressure could lead to sharper price corrections, particularly in highly leveraged markets like cryptocurrencies. Altcoins, often more volatile than major assets like Bitcoin, may face amplified declines as speculative capital exits. Meanwhile, institutional players, who rely on sophisticated risk management, might exploit this sentiment shift by accumulating at lower prices, setting the stage for future rebounds.

However, the bearish tilt isn’t universal. Some analysts argue that declining funding rates could reflect a healthy market correction, flushing out over-leveraged positions and creating a more stable foundation. Others caution that external factors—such as macroeconomic trends or regulatory developments—could exacerbate or reverse this sentiment.

As the market navigates this cautious phase, traders are advised to monitor funding rate trends closely, alongside other indicators like open interest and liquidations. The current environment rewards discipline and adaptability, as the balance between fear and opportunity hangs in the balance.