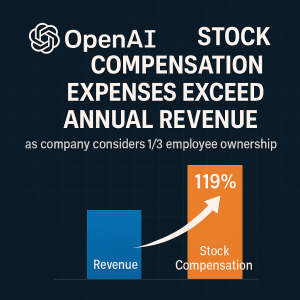

According to PANews, OpenAI’s stock compensation expenses surged to 119% of the company’s total revenue last year. The eye-catching figure underscores the intense competition for top AI talent and the growing costs associated with retaining employees amid the generative AI boom.

OpenAI’s ambitious equity strategy: Stock compensation expenses now exceed annual revenue as the company considers granting employees ownership of about one-third of its shares.

OpenAI’s financials have drawn mounting scrutiny as the company scales its product offerings—including ChatGPT and partnerships with major technology companies—while navigating significant operational costs. Sources familiar with the matter say the company has explored plans to allow employees to own approximately one-third of shares in a restructured corporate entity.

This potential move could align incentives between OpenAI’s workforce and its broader mission to advance artificial general intelligence (AGI). However, it also reflects the challenges of balancing rapid growth and sustainable financial practices in the highly capital-intensive AI sector.

The report did not specify a timeline for implementing the ownership plan or detail whether additional outside investment would be necessary to fund these employee equity grants.